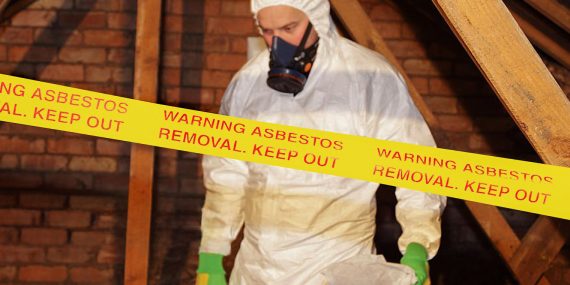

Asbestos

Asbestos is a naturally occurring mineral that was once widely used in construction materials for its heat resistance and durability. However, prolonged exposure to asbestos fibers can lead to serious health issues, including lung cancer, mesothelioma, and asbestosis. Asbestos is still present in many structures and is still used in some industrial processes and commercially available products. Cal/OSHA:The Department of Industrial Relations’ Division of Occupational Safety and Health is a state agency responsible for ensuring workplace safety and health in California. Its primary mission is to promote and enforce occupational […]