How Zoning Code Effects Church Property Use

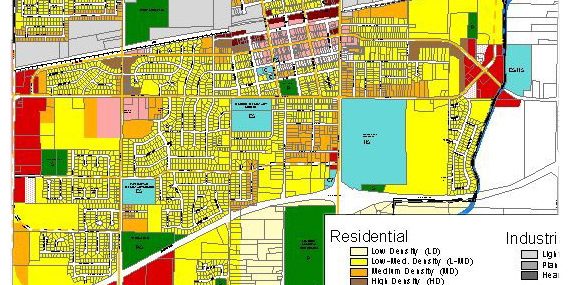

Municipalities establish a General Plan which contains the overall land use scheme by restricting some areas to particular usages. These governmental actions must not be arbitrary, capacious (unreasonable) or vague. Zoning regulations, or codes, must be reasonable and bear a rational relationship to the objectives of the city, while taking affirmative measures to provide housing for all. Municipalities have been given reasonable control over the private use of land from the state through enabling statutes for the protection of the health, safety, morals, and general welfare of its citizens. Legal […]