Churches and For-Profit Tenants

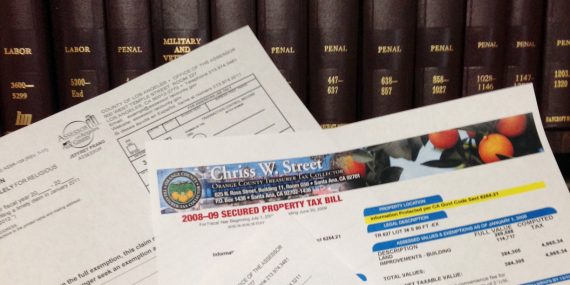

It often becomes necessary for a church to seek out tenants in order to meet the financial needs of the congregation. Some are happy to open their doors to other churches, while other desire schools or other groups to make better use of their facilities. Regardless of the approach, the type of tenant sought after can make a world of difference regarding your property taxes, especially if the tenant is a for-profit organization. The following is a brief overview and the proper professional should be consulted as the laws in […]