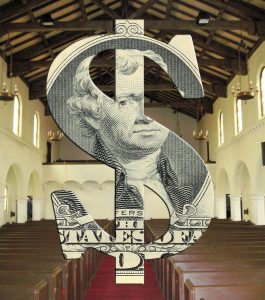

The Special Use Property Appraisal

(With insertions of opinion as to the appraisal of a religious property)

The California Bureau of Real Estate Appraisers Practice Act defines an appraisal the act or process of developing an opinion of value for real property, and does not include an opinion given by a real estate licensee or engineer or land surveyor in the ordinary course of his or her business. The standards used within the appraisal profession are set forth in the Uniform Standards of Professional Appraisal Practice (USPAP) which were developed by the Appraisal Standards Board of The Appraisal Foundation.

Purpose of an Appraisal:

An appraisal may be necessary for any number of reasons. The most obvious examples are transferring title, determining a buying or selling price, or obtaining a loan. Other, not so common reasons could be for a 1031 exchange, Probate, to determine gift or inheritance taxes, donation value, or in eminent domain proceedings.

Depending on the purpose of the appraisal, different approaches to arriving at an opinion of value may be necessary.

Types of Appraisals:

The Income Approach attempts to show the relationship a property has in relation to the income that can be derived from it. This approach, however, has no place in the appraisal or value of a special use built property (religious). Generally, there is no relationship between income derived and the value of a special use property as a church is not built to earn a profit, and thus, the resulting income return on investment, if any, is not measured in dollars by such an owner. Few churches are rented for the exclusive possession of the tenant, and even if so, not at a rent that might be considered market rent, as compared to other types of commercial uses.

The Market Approach compares the recent sale values of other similar or comparable properties to the subject property. Adjustments are made in significant variations, such as land size or zoning, building ages, size, condition, and construction. This theory is applicable, but not always available in actual practice in the marketplace as they relate to the subject property. If applied properly, these adjustments can be good indicators of value, but not necessarily conclusive. This approach is somewhat applicable to religious properties, as only a very limited number of open market sales are generally found, and not always a good comparable. These religious sales can offer very little true comparisons as to the appraisal assignment. As such, these often require large value adjustments in determining a value comparison. There can be a lack research of the sales comparisons reasoning in understanding the complexities and motivation of the a religious sale used in determining the final sales value attained.

The Cost Approach attempts to show what the land and building would cost to construct at a present-day cost, using current construction technology, materials, and techniques. Analysis for such items as type of construction, materials, amenities, and quality of materials is necessary for the new construction and other site improvements. In this approach, an estimate is made of the current dollar replacement costs of the existing improvements. The improvement value is based upon the replacement cost, or the reproduction cost of the construction components. From this figure is deducted the estimated accrued depreciation, when applicable. The depreciation used is a factor of age, condition, and type of construction of the subject property. To this depreciated value is added the value of the land.

Obtaining the Correct Opinion of Value:

Generally speaking, Special Use Property is a generic zoning term associated with, and also as a synonym to Special Purpose Properties. Special Purpose Properties are defined in California as Special use or special purpose property is property that, because of its uniqueness, has no relevant market for purpose of comparable sales. The California Code of Civil Procedure 1235.155 states “Non-profit, special purpose property means property which is operated for a special nonprofit, tax-exempt use such as a school, church, cemetery, hospital, or similar property.”

All real property is considered unique as no two parcels of land are like or equal to one another. This unique character is what makes two otherwise similar properties, different in value. Additionally, religious use properties have a limited market in that there are relatively few potential buyers. To be more precise, Special Use deals specifically with permitting an exception to the otherwise permitted use on a parcel of land by the local zoning authority. Not to be confused with a Conditional Use.

Depending on your circumstance, a Certified General Appraiser will often be necessary in or to value a Special Purpose Property. A Certified General Appraiser is the highest certification one in the field can receive and permits them to value all real estate without regard to transaction value or complexity. In this instance, a Residential or Certified Residential appraiser should not be utilized. As this certification implies, they are not licensed to provide an opinion of value for anything greater than a 1-4 family property with limitations on value and complexity; and non-residential property with a transaction value up to $250,000.

Appraisals in Litigation:

Litigation involving the value of Special Purpose Property most often arises in either Eminent Domain or Inverse Condemnation proceedings. Although a formal Court proceeding may not necessary result from either, a litigation appraisal from a Certified General Appraiser, although costly, is usually a must. In either instance, the parties will at some time trade appraisals to compare and contrast values. Although no two appraisers will arrive at the exact same number, when the same approach discussed above is use by both, they should be in the same value range.

Appraisal Cost, (on average):

- Residential, (single family); $300 – $500

- Residential, (up to four units); $700 – $1,000

- Commercial; $2,500 – $5,000

- Special Use; $8,000 – $10,000

- Litigation; $20,000 – $40,000

Please see our other related articles

Why Use Bushore Real Estate

Church Officer and Director Liability

How Zoning Code Effect’s Church Property Use

Eminent Domain and Inverse Condemnation

Disclaimer: Every situation is different and particular facts may vary thereby changing or altering a possible course of action or conclusion. The information contained herein is intended to be general in nature as laws vary between federal, state, counties, and municipalities and therefore may not apply to any given matter. This information is not intended to be legal advice or relied upon as a legal opinion, course of action, accounting, tax or other professional service. You should consult the proper legal or professional advisor knowledgeable in the area that pertains to your particular situation.